Mortgage rates are one of several factors that impact how much you can afford if you’re buying a home. When rates are low, they help you get more house, for your money. Within the last year, mortgage rates have hit the lowest point ever recorded, and they have stayed in the “historic-low” zone. But even over the past few weeks, rates have started to rise.

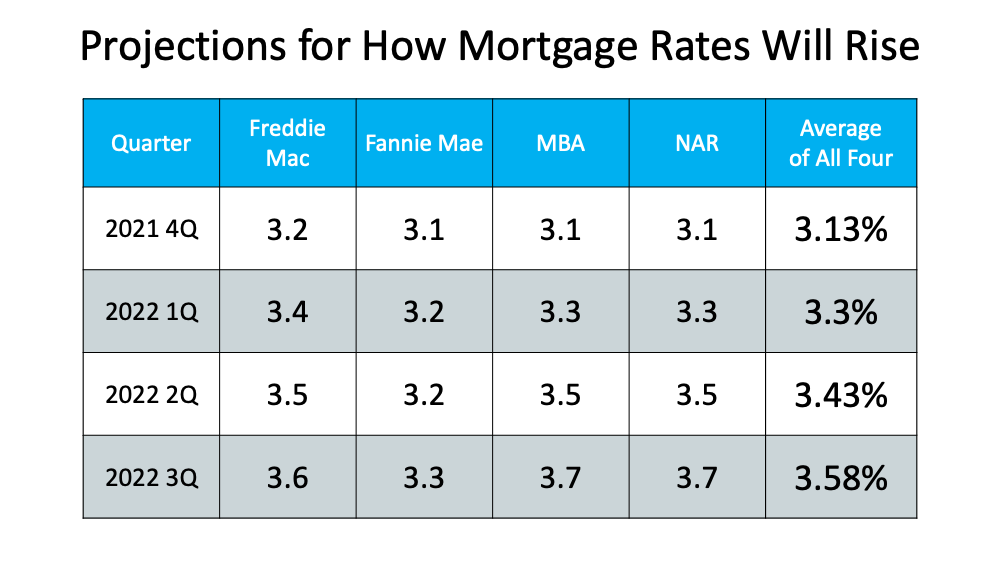

What does this mean if you’re thinking about making a move? Waiting until next year will cost you more in the long run. According to Freddie Mac, the average 30-year fixed-rate mortgage (FRM) is expected to be 3.0% in 2021 and 3.5% in 2022. Fannie Mae is forecasting mortgage rates at an average 3.3% in 2022, which, though slightly higher than 2020 and 2021, by historical standards remains extremely low and supportive of mortgage demand and affordability. If the rates rise even a half-point percentage over the next year, it will impact what you pay each month over the life of your loan – and that can really add up. So, the reality is, as prices and mortgage rates rise, it will cost more to purchase a home.

Bottom Line

Whether you’re considering buying your first home, moving up to your dream home, or downsizing because your needs have changed, purchasing before mortgage rates rise even higher will help you take advantage of today’s home buying affordability. That could be just the game-changer you need to achieve your homeownership goals. If you’re thinking of buying or selling over the next year, it may be best to make your move sooner rather than later – before mortgage rates climb higher. CALL ME!